Could CCIV Stock Fall to $15 Before Lucid Motors Merger Date?

Contents:

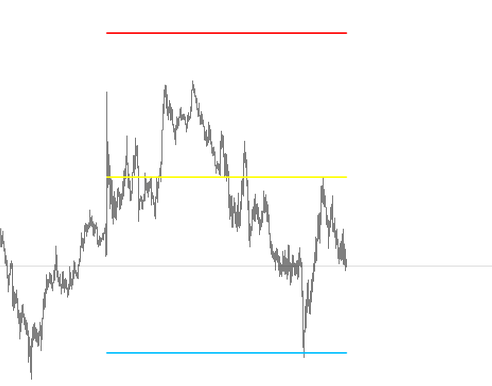

Churchill Capital , which announced a merger with Saudi PIF backed Lucid Motors, has now fallen below $19 and is at the lowest level since the merger announcement. CCIV stock could fall more and trend towards the $15 price level before the Lucid Motors merger date. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Lucid nor CCIV presently know or that Lucid and CCIV currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements.

Lucid Motors Achieves Another Milestone as the SPAC Churchill Capital Corp. IV (CCIV) Shares Now Trade at an Attractive Discount – Wccftech

Lucid Motors Achieves Another Milestone as the SPAC Churchill Capital Corp. IV (CCIV) Shares Now Trade at an Attractive Discount.

Posted: Mon, 08 Mar 2021 08:00:00 GMT [source]

My only fear is the SPY taking a poop on us somelos zetas this week, dragging that $30 target further and… Note that the ASIC-initiated licence variation will not extend to the “operate the business and conduct the affairs of the CCIV” authorisation that a corporate director will require. Such authorisation will need to be obtained in the usual manner through a licence application or variation.

Churchill Capital Stock charged up

It intends to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination with one or more businesses. The company was incorporated in 2020 and is based in New York, New York. Speaking of Tesla, the electric vehicle industry leader released the newest beta version of its FSD full self driving software to vehicles on Monday. FSD Version 9.0 hit Tesla vehicles via a software update, as the company continues to work towards autonomous driving and robo-taxis.

It is worth mentioning again that SPACs have no underlying business, revenue stream, EPS etc. The SPAC share price will be determined by the perceived skill and experience of the underlying SPAC founders, the sector and/or company the SPAC will target. A CCIV and its initial sub-fund will be established upon registration. The corporate director of a CCIV may apply to register subsequent sub-funds.

The second time was the charm for CCIV shareholders, who showed up on Friday to pass all seven proposals. Thursday’s shareholder vote was adjourned to Friday following one of the proposals not receiving enough votes, which temporarily stopped the merger from going through. The situation was the source of some humor on social media, as Lucid is known to have one of the most vocal retail followings around.

Finding the Best Stocks to Buy Amid Market Volatility

Expect Lucid to trade alongside Tesla as most of the electric vehicle industry does. If Tesla reports weaker guidance for the rest of the year, especially if it has to do with the global chip shortage, Lucid may see its price pull back as well. In 2019 SPACs raised over $13 billion in capital, while in 2016 the comparable figure was just $3 billion. Virgin Galactic was funded by a SPAC stake before launching its IPO. SPAC’s generally IPO at $10 and must keep this IPO cash raised ($10 times the number of shares issued) in a trust. If after two years the SPAC has not acquired a business, it must return the initial investment to shareholders.

Should You Still Trust Lucid? (NASDAQ:LCID) – Seeking Alpha

Should You Still Trust Lucid? (NASDAQ:LCID).

Posted: Thu, 04 Aug 2022 07:00:00 GMT [source]

A https://1investing.in/ director cannot be authorised to provide this financial service as a representative of an AFSL holder. Uniquely though, a CCIV must have a single corporate director which must be an unlisted public company that holds an Australian financial services licence . The firm was formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. The company was founded by Michael Klein and is headquartered in New York, NY. Lucid Motors will now debut on the NASDAQ exchange on Monday instead and trade under the ticker symbol LCID. Monday is turning out to be a big day in the industry as Tesla is also set to announce its second quarter earnings after the market closes.

CCIV Stock – Frequently Asked Questions

A corporate collective investment vehicle is a new type of company that can be registered from 1 July 2022. The CCIV framework was introduced by the Corporate Collective Investment Vehicle Framework and Other Measures Act 2022, including adding a new Chapter 8B to the Corporations Act 2001 . By deeming each sub-fund to be a separate unit trust, the new tax laws are intended to allow a sub-fund to pass threshold criteria of the AMIT regime so that it and its members can be eligible for attribution flow-through taxation treatment. If the CCIV does not meet the amended AMIT eligibility criteria, the general trust taxation rules will apply. Notwithstanding its corporate structure, a CCIV will not be taxed as a company .

‘Attribution Investment Vehicle’‘CCIV sub-fund trust’Independent depositary required? The CCIV has been challenging because of two compounding contradictions. First, the CCIV must be a single legal form company that paradoxically comprises ‘single responsible entity’ sub-funds, each with segregated assets and liabilities. Second, the CCIV must ‘flow through’ franking credits, discount capital gains and foreign income tax offsets to investors, which fundamentally contravenes our company tax rules, which are based on legal form. Similar to the present entitlement rules discussed above, this is a limitation on the standard powers of the trustee to determine the trust income in accordance with the terms of the relevant trust deed.

The formula for calculating fixed entitlement has been deliberately matched to the rights of the share, rather than proportionate holding, to reflect that there may be multiple classes of share per sub-fund . The Commissioner has no discretion to extend the three month window for payment of dividends, making it important that CCIVs act promptly to ensure any dividends are paid within that window. The new rules, however, introduce specific deeming rules regarding an investor’s ‘fixed entitlement’ and ‘present entitlement’. The Commissioner has a discretion to extend this three month timeframe.

A sub-fund of a CCIV is all or part of the business of a CCIV, and not a separate legal entity. Where a CCIV has two or more sub-funds, the assets and liabilities of the CCIV must be assigned to sub-funds. The Corporations Act sets out rules in relation to how assets and liabilities must be assigned to sub-funds, including in the case where an asset or liability relates to the businesses of two or more sub-funds. Each sub-fund’s assets and liabilities must be segregated from the assets and liabilities of other sub-funds and can only be applied for specific purposes, such as a sub-fund applying assets to meet the liabilities of that sub-fund.

A CCIV’s PDS will generally be subject to the same content requirements that apply to the PDS for other financial products. ASIC considers that AFSL holders authorised to provide financial product advice on and/or deal in MIS should be able to transition readily to the CCIV regime. Have at least one sub-fund, with each sub-fund having at least one shareholder and its own class of shares. From 1 July 2022, a new type of investment product – the Corporate Collective Investment Vehicle – will be able to be established by Australian fund managers.

- It is expected that the States and Territories will begin releasing draft legislation determining how the duties regimes will apply to CCIVs for all purposes, including during a restructure, now that the income tax regime has been established.

- Golden Star Signal is when the short-term moving average, the long-term moving average, and price line meet in a special combination.

- A key feature of the CCIV structure is that such cross-class liability risk is removed as the assets of each sub-fund can legally only be applied for purposes relating to that specific sub-fund.

- Ethereum blockchain’s Shapella upgrade is on track and set to go live on Wednesday, April 12.

Unique to Barchart.com, data tables contain an option that allows you to see more data for the symbol without leaving the page. Click the “+” icon in the first column to view more data for the selected symbol. Scroll through widgets of the different content available for the symbol. The “More Data” widgets are also available from the Links column of the right side of the data table. Barchart Premier Members may also download additional data using the “Historical Data” page, , where you can download Intraday, Daily, Weekly, Monthly, or Quarterly data (going back to Jan. 1, 1980). You can also view the latest trades, and view corporate actions (U.S. equities only) by selecting the appropriate tab.

As a company limited by shares, the CCIV will be a legal entity in its own right and will issue shares to shareholders like any other such company. In this article, we take a look at what a CCIV is, how it will operate, and what the licensing and regulatory requirements are under the financial services laws. Stay up to date with the latest content by subscribing to Electrek on Google News. You’re reading Electrek— experts who break news about Tesla, electric vehicles, and green energy, day after day. Be sure to check out our homepage for all the latest news, and follow Electrek on Twitter, Facebook, and LinkedIn to stay in the loop.

Initial reviews are muted, with several industry experts stating that the upgrade had no substantial improvement over the previous version. Thursday marks the day that investors have been waiting months for, as shareholders will vote on the official merger between CCIV and Lucid. The vote should pass with little doubt, although shareholder bullishness comes despite question marks about production time for its cars. Lucid continues to be vague about the exact release date for its Lucid Air sedans, as well as estimates on future scaling.

Lucid has just made public via Twitter that European deliveries will be in late 2021. Information and guides to help to start and manage your business or company. Real-time analyst ratings, insider transactions, earnings data, and more. One share of CCIV stock can currently be purchased for approximately $8.03.