Automatic Change to Cash Method of Accounting for Tax

Contents:

The more complex accrual method conforms to the matching principle under GAAP. That is, companies recognize revenue in the periods that they’re earned . This method reduces major fluctuations in profits from one period to the next, facilitating financial benchmarking. Businesses that are eligible to use the cash method of accounting for tax purposes have the ability to fine-tune annual taxable income.

This can range from overseeing the transition on your behalf to helping you, after the switch over, with areas such as forecasting and budgeting. It might be hard to conceptualize when the difference between cash and accrual accounting matters. There are several standard examples a business owner might come across. When your company receives customer payment, your total accounts receivable will decrease as your bank account increases.

IRS Issues Tips on How Tax Reform Affects Farmers and R…

Cash accounting tracks the actual money coming in and out of your business. Despite these pitfalls, the overall conversion process works well, and it is one of the best QuickBooks features to help business owners assess performance. Select “display” tab and click “cash” or “accrual” in the report basis section.

What Are Accruals? How Accrual Accounting Works, With Examples – Investopedia

What Are Accruals? How Accrual Accounting Works, With Examples.

Posted: Tue, 13 Dec 2022 08:00:00 GMT [source]

For example, if you have $10,000 in your bank account but owe $10,000 on an inventory order, cash accounting won’t reflect that. So companies with large inventories generally can’t use cash accounting, even if they are small. The accrual basis uses a matching principle, in which you match expenses to the revenue they help generate in the same period. If there is no cause-and-effect relationship between the expenses and revenue, you record those costs immediately.

As money is earned it is categorized as assets or liabilities on the balance sheet. Once the money is recognized it moves to the income statement. This gives a business owner a window into future income or expenses. When the exact value of an item cannot be easily identified, accountants must make estimates, which are also considered adjusting journal entries. The accrual method is the more commonly used method, particularly by publicly-traded companies. One reason for the accrual method’s popularity is that it smooths out earnings over time since it accounts for all revenues and expenses as they’re generated.

With cash-basis accounting, you do not record accounts receivable in your books. To switch to accrual, add any unpaid customer invoices to your books. To convert your books from cash basis to accrual, you will need to complete several tasks. First, you must adjust your books to reflect the accrual method. You must also fill out and file a form with the IRS to request the change. So this question is similar to the one above, except the question provides us with the amount of invoices received during the period.

Accrual Method

With the cash basis, you account only for the money you receive and spend in a given period. With accrual accounting, you account for what revenue you’ve earned and expenses incurred, regardless of whether the payments for these are made before or after the period. The accounts above provide examples of adjustments needed for a cash to accrual conversion. When using online accounting software, checks and balances built into the double entry system ensure that accrual entries are entered correctly and properly balanced. An accounting or tax professional can provide additional advice on the conversion process and how this change affects a company’s financial statements.

This means the IRS will not require a taxpayer to change accounting methods for the same item in the year prior to the change. Do not make the reconciliation in your regular account book or software program. If you do that, you may erase all the accrual income and expenses you’ve recorded.

Cash to accrual for inventory and cost of goods sold?

We incurred the expense in the prior period, meaning we already recorded it. Once it is paid we reverse the entry, but it does not belong in the current period. Once they are paid they are expensed on the income statement. Accounts payable are considered current liabilities on the balance sheet. Businesses can figure their taxes on either an accrual or a cash basis.

- Chizoba Morah is a business owner, accountant, and recruiter, with 10+ years of experience in bookkeeping and tax preparation.

- For accounting homework help or any type of questions on accounting, ask Transtutors’ experts available 24×7 to help students.

- The key advantage of the cash method is its simplicity—it only accounts for cash paid or received.

The cash basis method typically is used by sole proprietors and smaller businesses. So the beautiful thing about the balance sheet approach is that the inventory rollforward is set up exactly the same. So if beginning inventory was $500, then to get to cost of goods available for sale of $1,750, that means we purchased $1,250 of material.

In fact, a business can legally lower its tax liability by simply controlling the timing of the cash payments. Since cash-basis accounting doesn’t show liabilities , a cash-rich business with a high accounts payable can appear more solvent than it actually is. Regardless of what basis you use to run your business or report your taxes, it’s helpful to analyze your company’s performance from different angles.

Accrual Accounting vs. Cash Basis Accounting: What’s the Difference?

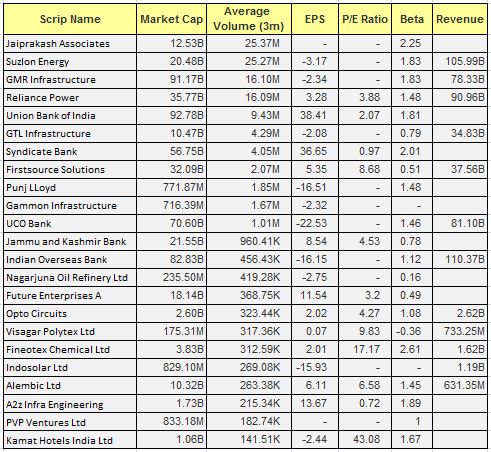

The differences between the standard amount of cost and the actual amount that the organization incurs is referred to as a variance. We help that this article helped you in your process of understanding accrual to cash conversions. For more articles like this be sure to check out our dedicated accounting and Chartered Financial Analyst pages. Let’s simplify the cash to accrual conversion with an example. For tax purposes, companies with over $26 million revenue in the previous three years must use accrual.

- The following video summarizes the difference between cash and accrual basis of accounting.

- Material cost was budgeted for $5 per pound and the actual cost was $8 per pound.

- In addition, accrual-basis entities report several asset and liability accounts that are generally absent on a cash-basis balance sheet.

- The TCJA liberalized the small business definition to include those that have no more than $25 million of average annual gross receipts, based on the preceding three tax years.

One of the most challenging things when you are first learning about inventory and cost of goods sold is understanding the way it moves through the financial side of your business. Enter historical invoices or bills if you have a remaining balance. These are the unpaid invoices or bills dated prior to your conversion date.

These can be found under the https://1investing.in/ liabilities section of the balance sheet, as accounts payable or farm taxes due. Subtract the total value of these items at the end of the year from their total value at the beginning of the year to compute the adjustment . Do not include the principal portions of loans or contracts owed, because repayment of principal is not considered an expense for accounting or tax purposes.

Accrual Accounting vs. Cash Basis Accounting: What’s the Difference? – Investopedia

Accrual Accounting vs. Cash Basis Accounting: What’s the Difference?.

Posted: Sat, 25 Mar 2017 07:59:39 GMT [source]

Once project accounting is received, the accrual accountant debits cash and credit accounts receivable. Accounts receivable is an asset account because it is an obligation from a customer to pay for products or services already received. Costs that are incurred in the current period and paid in the next must be recognized in the period they are incurred. For example, utility companies typically bill customers based on actual charges at the end of the period. A cash accountant would not record an expense until the later period when the bill is paid.

When you leave a comment on this article, please note that if approved, it will be publicly available and visible at the bottom of the article on this blog. For more information on how Sage uses and looks after your personal data and the data protection rights you have, please read our Privacy Policy. Accrual gives a more accurate picture of that, especially if done in conjunction with careful cash flow monitoring, she says. Learn how thousands of businesses like yours are using Sage solutions to enhance productivity, save time, and drive revenue growth. Sage Intacct Advanced financial management platform for professionals with a growing business. The IRS also gives farmers several choices of how to depreciate the cost of purchasing durable assets such as machinery and buildings.

They cannot have in-house financing, as that requires accounts receivable. Accounts receivable represents money that is owed to a firm but not yet paid. The business provided the good or service but has yet to receive the money for doing so. Accounts receivable are considered current assets and are listed on the balance sheet. The periodicity assumption requires preparing adjusting entries under the accrual basis. Without the periodicity assumption, a business would have only one time period running from its inception to its termination.

If your customers pay in advance, you may have recorded revenues that you haven’t yet earned. Your accountant will remove that revenue from your income statement, shifting it to a deferred revenue account on your balance sheet. Under the cash method, companies recognize revenue as customers pay invoices and expenses when they pay bills. As a result, cash-basis entities may report fluctuations in profits from period to period, especially if they’re engaged in long-term projects. This can make it hard to benchmark a company’s performance from year to year — or against other entities that use the accrual method. If the debate between cash basis vs accrual basis accounting were a popularity contest, accrual accounting would win by a landslide.

They make up the conversion balances of accrued and deferred accounts . Keep this in mind, for when you go to make a change in the current period. The difference between the two balances is the adjustment that needs to be addressed in the year of change. AcountDebitCreditExpenses200Cash200Total200200In cash basis, you only recognize the amount you actually paid.