Direct & Indirect Method of Cash Flow Forecasting

Readers may wish to consider whether a preventative treatment with a mortality of 25% would really be acceptable for most patients destined to develop this disease. To verify the primary method, we also reviewed the Tufts database of utilities24 for any studies that compared the utilities within the same group of respondents. A preliminary phase in the bread making process is included in many Italian language recipes written for the home baker, but the particular method is rarely referred to by name. The following information is included, because it represents the identification and description of one of these methods, the crescente.

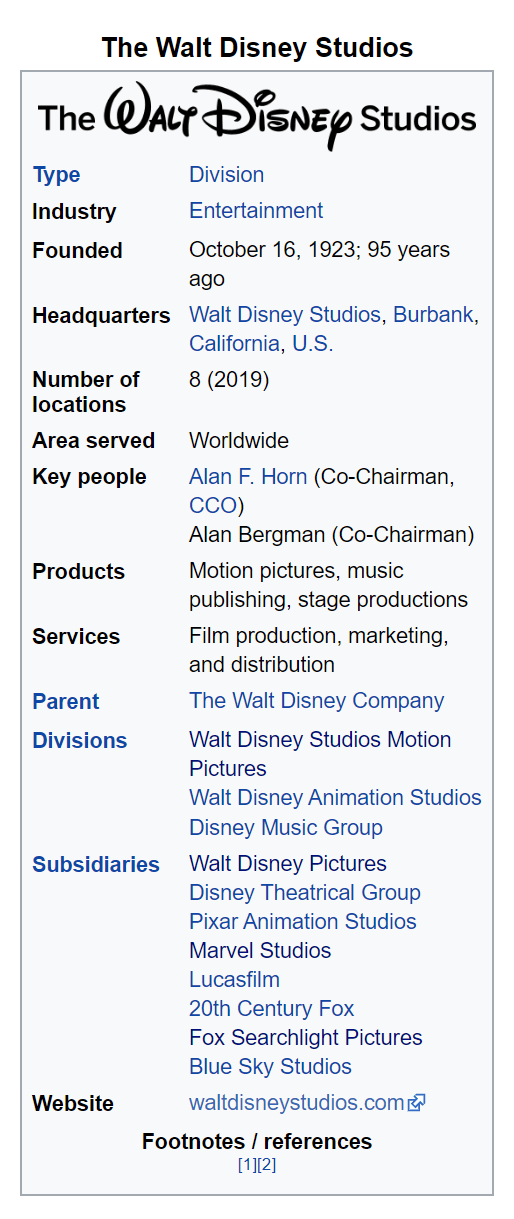

Notably, you can make your collections efforts more effective by using accounts receivable software that reduces nonpayment and encourages faster payment via a collaborative approach. Cash flow management is an essential element of business operations. Cash flow is movement of money in and out of your business, and net cash flow is the difference between the money that comes into a business and the money that flows out during a given period. The indirect method, by contrast, means reports are often easier to prepare as businesses typically already keep records on an accrual basis, which provides a better overview of the ebb and flow of activity.

If the subject alleges additional currency business expenses not claimed on the return, these should be allowed, after adding a like amount to the cash expenditures figure in the computation. When non-negotiated instruments are purchased by check, total deposits are increased by the amount of the non-negotiated instruments. This is similar to a transfer as money deposited in the bank is being converted to a non-negotiated instrument. One important difference between many brokerage statements and bank statements is that, when a stock is sold, the amount of the sale appears as a credit to the account on the date of the sale.

If the cycle is too fast, you may not be using available debits and credits effectively. For example, you could use surplus cash to pay off old debts or put some excess funds into investments. B. Size of operation—In many instances, gross profit, cost of goods sold, and net profit percentage on sales will vary according to the size of a business.

Alternatively, the indirect method starts with accrual basis net income and indirectly adjusts net income for items that affected reported net income but did not involve cash. The cash flow statement is divided into three categories—cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities. Although total cash generated from operating activities is the same under the direct and indirect methods, the information is presented in a different format. This direct method of cash flow accounting is based on the cash method of accounting, so companies that use cash accounting will find it simplest to use the direct cash flow method. You don’t need to make any adjustments to translate the cash basis into operating cash flows, but you will need to manually reconcile net income to the cash provided by operating activities. Under the direct method, the only section of the statement of cash flows that will differ in the presentation is the cash flow from the operations section.

Accounting for Managers

If sub-appendices are used, they must refer to the proper witness, the exhibit number, and a description of the evidence used to support the item. In investigations utilizing a detailed computation of net worth, the factual data may be best presented via a summary of the details broken down into at least one main appendix and various sub-appendices. G. In the event the special agent is unable to firmly establish a starting point through the above-described steps, the special agent may have to rely upon an indirect approach to establishing a starting point. This can be accomplished by using a Source and Application of Funds computation.

- If you need help with managing your books and payroll give these guys a shout.

- Primary distinction between the direct and indirect cash flow statements is that operating activities generally report cash payments and cash receipts occurring throughout the business in the direct method.

- Both allow you to present cash flow from operations using either the direct or indirect method.

- Whatever method is used, it must be used for all prosecution years.

- The special agent should attempt to obtain and then corroborate the details of the claimed loans by interviewing the individuals who allegedly made the loans to the subject.

The direct method focuses on operating assets while the indirect method focuses on liabilities. To determine which one to use, you can add or subtract operating assets and liabilities. You can also view net income by subtracting expenses.

A. Type of merchandise handled—In order for a proper comparison to be made, the businesses must be dealing in the same type of merchandise or service. Comparison of the gross profit of a restaurant with that of a grocery store would be of little value and should not be used. The percentage markup method is used on a limited basis. If the deposits or expenditures are from funds accumulated in prior years, they do not represent current income. If the subject unintentionally overstated expenses, no adjustment is necessary. The subject would be allowed the expenses per the return.

They cannot be used to accurately predict direct utilities for particular health states. However, such an adjustment may be better than nothing, because the adjusted utilities are well calibrated on average. Further development in the science of utility estimation could make a contribution by identifying the characteristics of disease states for which the average adjustment is inappropriate. Our findings show that the versatile and convenient indirect methods of utility measurement yield different results from those obtained by the direct methods.

Direct vs. Indirect Cash Flow

The cost of goods sold is then included in the computation of gross income. These steps are illustrated in the bank deposits formula. If the subject claimed business expenses on his/her return in excess of the amount of business expenses he/she paid by check, the balance should be treated as a cash expenditure and included in the bank deposits computation.

- The direct method of preparing the statement of cash flows shows the net cash from operating activities (we won’t look at investment or financing activities).

- Cash flow is movement of money in and out of your business, and net cash flow is the difference between the money that comes into a business and the money that flows out during a given period.

- The direct method, on the other hand, is often the best choice for smaller businesses, as the transparency into operating cash flow details helps them better determine their short-term cash availability planning needs.

- Calculating operating cash flow is a bit more complicated, as you can do so using either the cash flow direct method or cash flow indirect method of accounting.

- The indirect method is the more complex and common way of preparing the cash flow statement.

The difference lies in the presentation of cash flows from operating activities. The theory behind the bank deposits method of proof is simple. There are only three things a subject can do with money once it is received, i.e., he/she can spend it, deposit it, or hoard it. Accounting for these three areas considers all funds available to the subject. If non-income sources are eliminated, the remaining currency expenditures, deposits, and increases in cash on hand will equal corrected gross income.

Entrepreneurs and Small Business

While the direct method focuses on the cash transactions of the business, the indirect method is more accurate. The direct method focuses on the cash inflows and outflows, which helps the business plan in the short term. Although the two methods are similar in concept, the methods have some distinct advantages and disadvantages. The direct method uses the accrual basis of accounting, while the indirect method uses the cash basis. While both are ways of calculating your net cash flow from operating activities, the main distinction is the starting point and types of calculations each uses. Since it draws on data you’re already using in your profit and loss (P&L) statement and balance sheet, the indirect method is less complicated for teams to prepare, meaning it offers significant time savings.

Furthermore, many businesses don’t favor direct cash flow reporting because it can increase the amount of work they have to do to stay in compliance with certain rules. So, what are the differences between direct and indirect cash flow methods? First, let’s look at the head-to-head differences between the direct and indirect cash flow methods. Direct cash flow forecasting is generally more accurate than indirect cash flow forecasting because the forecast is based on actuals. However, some factors may affect the accuracy of direct cash flow forecasting, such as delayed payments. Further down the forecasting period, the accuracy decreases.

Direct vs. Indirect Cash Flow Method Head to Head Differences

Additionally, the specific item of proof method is the hardest for the subject to rebut. Check out our guide to accelerating collections to learn more about how this type of support can help your business improve your cash flow—leading to cash flow statements that you’ll be happy to see. At the same time, it can help shore up your cash flow by ensuring you’re capturing all the revenue that is owed to you.

The direct method is often used in tandem with the cash method of accounting, where money is only accounted for when it changes hands. The income statement method is another name for the direct approach. This paper adds weight to the recommendation to be cautious when using utilities of any type. In the construction of health economic models it may be prudent to extend the range of uncertainty beyond the confines of statistical confidence limits and conduct a sensitivity analysis. In that case, the results presented here suggest that indirect utilities might best be used to populate only the lower limits of such an analysis. Secondly, it is likely that the respondents who contribute trade off values for indirect utility elicitation differ systematically from the patients that participate in direct methods.

Uncertainty about the amount of cash on hand is a common defense in net worth investigations. It will be easier to refute this defense if the special agent has established a firm beginning and an ending cash on hand amount is established. Cash on hand is almost always proved by circumstantial evidence. An accounting is made showing how funds generated from income were applied by identifying increases to net assets and various expenditures. If no method of accounting has been regularly used by the subject, or if the method used does not clearly reflect income, special agents may use whichever method they believe clearly reflects the subject’s income. Whatever method is used, it must be used for all prosecution years.

It is far easier to present a https://1investing.in/ deposits investigation to a jury when many of the deposits have been specifically identified as current taxable income. For example, when multiple specific omitted sales are traced to the subject’s bank accounts, but other deposits of a similar nature remain unidentified, the government’s investigation is strengthened immeasurably. Through the specific identification of multiple omitted deposits, the special agent’s assertion that unidentified deposits of a similar nature are current taxable income becomes more credible. The bank deposits method of proof requires the special agent to conduct a thorough analysis of the deposits and canceled checks which relate to any and all bank accounts controlled by the subject. Additionally, the special agent must document the subject’ s currency expenditures and cash on hand.

International research team led by UTSA astrophysicist discovers … – UTSA

International research team led by UTSA astrophysicist discovers ….

Posted: Thu, 13 Apr 2023 19:04:23 GMT [source]

The cash flow statement is a critical statement as it helps the stakeholder evaluate the cash flow position of the business. Generally, a cash flow statement is composed of cash flow from operating activities, financing activities, and investing activities. For the direct and indirect methods of cash flow, the cash flows arising from the financing activities and investing activities tend to be the same. However, the approach utilized for the cash flow from the operating activities differs for both the direct method of cash flow statement and the indirect method of the cash flow statement.

Astronomers Have Directly Detected A Massive Exoplanet. The … – IFLScience

Astronomers Have Directly Detected A Massive Exoplanet. The ….

Posted: Fri, 14 Apr 2023 13:26:06 GMT [source]

Figure FSP 6-1 is an illustrative cash flow statement prepared using the indirect method. It reflects certain captions required by ASC 230 , and other common captions. Not all captions are applicable to all reporting entities. In addition, some captions may be reflected in other classification categories depending on facts and circumstances. There are two popular methods to calculate cash flow, the direct method and the indirect method.

Researchers use novel method to find a distant exoplanet – Engadget

Researchers use novel method to find a distant exoplanet.

Posted: Fri, 14 Apr 2023 17:51:42 GMT [source]

Both ways end up at the same answer, but in a different way. Cash Flow StatementA Statement of Cash Flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business. DepreciationDepreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. Its value indicates how much of an asset’s worth has been utilized. Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year. Cash management is the process of managing cash inflows and outflows.